Planning a budget is essential for anyone who wants to take control of their finances. Whether you’re a student, a homeowner, or a business owner, having a budget in place can help you track your income and expenses, pay off debts, and reach your financial goals. In this article, we will discuss the basics of budgeting and provide you with some key tips to create a budget that works for you.

The first step in planning a budget is to set clear targets and priorities. Make a list of your financial goals, whether it’s paying off your mortgage, saving for a vacation, or starting a business. Once you have a clear idea of what you want to achieve, you can start allocating your income accordingly.

Next, you need to assess your income. Calculate how much money you make each month after taxes and deduct any fixed expenses, such as rent or mortgage payments, insurance, and utility bills. Whatever is left over can be allocated towards your savings and other discretionary items.

When making a budget, it’s important to be realistic and consider your needs and expenses. You should also take into account unexpected costs, such as car repairs or medical bills. It’s always good to have a contingency fund in place to cover these miscellaneous expenses.

Remember, a budget is a tool to help you manage your finances, not to make you feel restricted. It’s okay to allow yourself some flexibility, especially when it comes to discretionary spending. However, it’s important to keep track of your expenses and make sure you’re not spending more than you can afford.

In conclusion, planning a budget is a process that takes time and effort, but it is worth it in the long run. Whether you’re a student, a homeowner, or a business owner, having a budget in place can help you reach your financial goals, pay off debts, and live within your means. So, start budgeting today and take control of your finances!

Budgets: Everything You Need To Know

Creating a budget is essential for financial planning. It helps you track and manage your income and expenses, ensuring that you stay within your financial limits and have the necessary funds to cover all your needs. Whether you’re a business owner, a student, or a homeowner, budgeting is a valuable tool that can help you make progress towards your financial goals.

The budgeting process starts with understanding your income and expenses. You need to know how much money you earn every month and, at the same time, track all your expenses. This includes not only everyday expenses but also those miscellaneous costs that can add up over time.

One key tip is to create a bottom-up budget. Rather than listing what you think you should spend, start by recording your actual expenses. This will give you a realistic view of where your money is going, and you can adjust your spending accordingly.

When planning a budget, it’s important to account for changing needs and circumstances. For example, if you’re a homeowner, you should consider the cost of home maintenance and repairs, as well as regular bills like heating and insurance. If you’re a business owner, you’ll need to include expenses related to running your business, such as marketing and accounting fees.

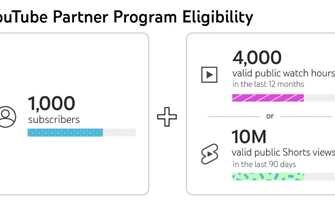

Huntington Bank suggests using the 50/30/20 rule as a guideline for budgeting. This means that 50% of your income should cover essential expenses like housing, utilities, and transportation. 30% can go towards discretionary spending, such as entertainment and eating out, while 20% should be allocated towards savings and paying down debt.

Remember, budgeting is a flexible process, and you can adjust your plans as needed. If you find that you’re spending more in one category than you anticipated, you may need to cut back in another area or find ways to increase your income. The key is to constantly review and track your progress.

There are numerous tools available to help you with budgeting, from mobile apps to spreadsheets. Find the one that works best for you and make it a habit to regularly update and review your budget.

It’s also worth noting that budgeting doesn’t mean you can’t have fun or treat yourself. By planning for leisure activities and setting aside a specific amount for entertainment, you can enjoy your hobbies and interests without jeopardizing your financial goals.

Lastly, while budgeting is an important part of financial planning, it’s crucial to remember that you are in control of your money. Use your budget as a guide, but also trust your instincts and make decisions based on your own personal circumstances.

In conclusion, knowing how to plan a budget is one of the key basics of financial management. By creating a budget, tracking your expenses, and making adjustments as needed, you can take control of your finances, cover your needs, and work towards your financial goals.

Key Takeaways:

- Create a budget that tracks your income and expenses.

- Account for changing needs and circumstances.

- Follow the 50/30/20 rule for budgeting.

- Review and adjust your budget regularly.

- Use budgeting tools to aid in the process.

- Remember to include leisure activities in your budget.

- Trust your instincts and make decisions based on your own circumstances.

Key Takeaways

When it comes to budgeting, there are a few key takeaways to keep in mind. First, it’s important to plan your budget for the next few months or even a year in advance. This allows you to take into account any upcoming expenses or changes in your income, ensuring that you are prepared for whatever comes your way.

Next, remember to make a list of all your expenses and prioritize them. This will help you determine what needs to be paid first and what can wait until later. Don’t forget to include essential items such as your mortgage or rent, utility bills, insurance, and everyday expenses.

Creating a budget should be a bottom-up process, starting with your income and subtracting all your expenses. This will give you a clear picture of how much money you have left over for savings, debt repayments, or discretionary spending.

It’s also important to track your spending on a monthly basis to ensure that you stay within your budget. This can be done through a budgeting tool or simply by keeping a record of your expenses. By doing so, you can identify any areas where you may be overspending and make necessary adjustments.

Remember to give yourself some flexibility in your budget. Life is unpredictable, and unexpected expenses can arise. Having a small emergency fund or a buffer in your budget will help you cover these costs without derailing your financial plans.

If you run a business, budgeting becomes even more crucial. Not only do you need to account for your personal expenses, but you also need to consider the costs associated with running your business. This includes things like employee salaries, office supplies, marketing expenses, and other operational costs.

Finally, take advantage of any discounts or special offers that can help you save money. Many businesses and organizations offer discounts to their customers, whether it’s for groceries, entertainment, or sports events. These savings can add up over time and help you stay within your budget.

In summary, budgeting is a powerful tool that helps you take control of your finances. By making a plan and sticking to it, you can make progress towards your financial goals and ensure that you are spending your money wisely.

Planning and Budgeting Process

Planning and budgeting are essential tools for managing your spending and achieving your financial goals. By creating a budget, you can track your income and expenses, and ensure that you are living within your means. The budgeting process is a way to plan how you will spend your money, and it helps you make progress towards your financial targets.

Before you start planning your budget, it is important to know what your financial goals are. Whether you want to save for a down payment on a home, pay off debts, or cover everyday expenses, understanding your needs and priorities will help you create a budget that works for you.

Once you know what you are working towards, you can start the budgeting process. Begin by tracking your income and expenses for a few months to get a clear understanding of your spending habits. This will give you a good idea of where your money is going and help you identify areas where you can make changes.

When creating your budget, remember to account for both fixed and variable expenses. Fixed expenses, such as your rent or mortgage payment and insurance premiums, are regular, predictable costs that you need to cover each month. Variable expenses, on the other hand, can change from month to month, like groceries, entertainment, and transportation costs.

To help manage your variable expenses, set spending limits for different categories and stick to them. For example, you could set a limit on how much you will spend on dining out or entertainment each month. This will help prevent overspending and ensure that you have enough money left over for your other financial goals.

It’s also important to account for unexpected expenses and emergencies in your budget. Set aside some money each month for these types of situations so that you have a financial cushion to fall back on when needed. This can help you avoid going into debt or relying on credit cards to cover unexpected costs.

Additionally, take advantage of discounts and deals to save money on your expenses. Whether it’s using coupons while grocery shopping or finding lower-cost alternatives for items you need, every little bit helps in stretching your budget further.

As your circumstances and priorities change, it’s important to review and adjust your budget accordingly. Regularly evaluate your progress and make changes as necessary to ensure that your budget continues to reflect your needs and goals. This will help you stay on track and make the most of your money.

In conclusion, budgeting is a valuable tool that can help you take control of your finances, plan for the future, and achieve your financial goals. By understanding your income, expenses, and needs, and creating a budget that works for you, you can make wise financial decisions and secure a more stable financial future.

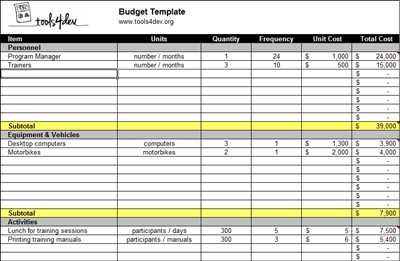

Create a list of monthly expenses

When it comes to budgeting, one of the key steps is to create a comprehensive list of your monthly expenses. This list will help you track your spending, plan your budget, and make sure you’re covering all your needs while also being mindful of your goals and financial targets.

Start by writing down all the expenses you know you have to pay every month, such as rent or mortgage payments, utility bills, insurance, and any debt payments. This is the backbone of your budget and should be accounted for first.

Next, go through your bank statements and receipts to identify any other recurring expenses you may have missed. This could include things like groceries, transportation costs, subscription services, gym memberships, and other everyday expenses. It’s important to be thorough and capture everything, as even the smallest expenses can add up and impact your budget.

While creating your list, be sure to account for any quarterly or annual payments you may have. These could include property taxes, car registration fees, or insurance policies that are paid once or twice a year. By factoring these in, you can anticipate when these expenses will occur and plan accordingly.

Additionally, take note of any miscellaneous or discretionary expenses that may not be regular, but still need to be accounted for. This could include things like holiday or birthday gifts, home repairs, or entertainment expenses.

As you create your list, consider categorizing your expenses to help you better understand where your money is going. This can also be a helpful tool for identifying areas where you can make adjustments or cut back if needed.

Remember, budgeting is an ongoing process and your expenses may change from month to month. It’s important to regularly review and adjust your budget as needed. By keeping track of your expenses and comparing them to your income, you can ensure you’re staying within your financial limits and making progress towards your goals.

While it may take some time and effort to create your list of monthly expenses, it is an essential step in the budgeting process. The more thorough and accurate your list is, the better you will be able to plan and allocate your funds. And the better you plan, the more control you will have over your finances.

So take the time to create your list of monthly expenses, track your spending, and see how it aligns with your income and financial goals. It may feel like a daunting task at first, but the benefits of budgeting far outweigh the efforts involved. With a well-planned budget, you can feel more in control of your money, avoid unnecessary debts, and even have some extra funds for those things you truly enjoy.

Huntington Customer Tip

When it comes to creating a budget, it’s important to be aware of everything within your financial landscape. Huntington Bank is here to help with a customer tip that can keep your spending in check while you plan for your everyday needs, unexpected expenses, and future goals.

The key to successful budgeting is to work from the bottom-up, tracking your income and expenses. This tool helps you understand where your money is going and allows you to make necessary adjustments to ensure you’re not overspending.

Start by listing all your sources of income, such as your salary, freelance work, or any other payments you receive. Then, make a list of all your monthly expenses, including necessities like mortgage or rent payments, utility bills, insurance costs, and debt payments. Don’t forget to include miscellaneous expenses like entertainment, eating out, and sports activities.

Once you have a clear picture of your income and expenses, it’s time to set limits. Determine how much you want to spend in each category per month and stick to those targets. If you find that you’re over your limits in certain areas, look for opportunities to cut back or find discounts that can help you save money.

Remember to plan for changing circumstances or unexpected events. Create a budget that covers not only your everyday needs but also potential emergencies or unplanned expenses. By setting aside a small amount each month, you can build an emergency fund that will give you peace of mind.

Huntington Bank also recommends keeping track of your progress. Regularly review your budget to see if it’s working for you. If you notice any areas where you’re consistently overspending, re-evaluate your budget and make necessary adjustments. It’s a good idea to check in on your budget every month and make changes as needed.

Lastly, Huntington Bank advises its customers to claim what’s rightfully theirs. If you’re eligible for any government assistance or discounts, make sure to take advantage of them. This can help ease the financial strain and allow you to put more money towards savings or debt repayment.

In conclusion, budgeting is an essential part of financial planning. By creating a budget that works for you and sticking to it, you can take control of your finances and make progress towards your goals. Huntington Bank is here to help you every step of the way, providing the tools and tips you need to succeed.

So, whatever the weather or the cost of heating your home, remember the Huntington customer tip: budgeting helps you account for everything and keeps you on track!

Budget basics

Creating a budget is a key part of financial planning. It helps you track your income and expenses, and ensures that you stay within your financial limits. Budgeting is a tool that businesses and individuals can use to plan for their future expenses and goals.

When making a budget, the first step is to determine your monthly income. This includes your salary, any other sources of income, and any benefits or payments you may receive. Once you know how much money you have coming in, you can start planning how much you want to spend.

Start by listing all of your monthly expenses. This includes necessities such as rent or mortgage payments, utilities, groceries, and transportation. It also includes any other fixed expenses you may have, such as insurance or loan payments.

Next, consider your discretionary spending. These are the expenses that are not necessary for day-to-day living, but are still important to you. This could include items such as dining out, entertainment, or hobbies. Be sure to also factor in savings and investments as part of your monthly expenses.

While planning your budget, it’s important to be realistic about your spending habits. Take into account any changing circumstances in your life, such as a new job or a baby on the way. You can also set specific goals for yourself, such as saving a certain amount of money each month, or paying off a debt by a certain date.

One helpful tip is to use a bottom-up budgeting process. This means starting with your fixed expenses and then adding in your discretionary spending. This will help you prioritize your needs and ensure that you have enough money to cover everything each month.

Remember, budgeting is an ongoing process. You should track your progress regularly and make adjustments as needed. If you find that you’re consistently overspending in certain areas, you may need to revisit your budget and make some changes.

A good budgeting tool can help you track your expenses and stay on top of your financial goals. Many banks offer budgeting tools within their online banking platforms, and there are also various mobile apps available to help you manage your budget.

Some key takeaways from budget basics include:

- Know your monthly income and expenses

- Create a list of all your expenses

- Set realistic goals for savings and debt payments

- Use a bottom-up budgeting process to prioritize your needs

- Track your progress regularly and make adjustments as needed

- Utilize budgeting tools available online or through mobile apps

By following these budget basics, you can take control of your finances and make sure you are spending your money in a way that aligns with your financial goals.

The Cold Weather Payment and Other Discounts: What Can You Claim to Help Cover the Cost of Heating Your Home

When the weather turns cold and the temperatures drop, it’s important to make sure your home is adequately heated. But heating costs can quickly add up, especially during the winter months. That’s where the Cold Weather Payment and other helpful discounts can come in handy. By taking advantage of these options, you can find financial assistance to help you stay warm without breaking the bank.

The Cold Weather Payment is a government program that provides extra money to eligible customers when the weather gets particularly cold. The program tracks the temperature during the coldest months and if it drops below a certain threshold for seven consecutive days, eligible customers receive a payment to help cover their heating expenses. This payment can be a welcome addition to your budget and can make a real difference in keeping your home warm during the winter.

In addition to the Cold Weather Payment, there are other discounts and assistance programs available that can help you save money on your heating costs. Many energy companies offer special discounts or payment plans for customers who struggle to pay their bills. These programs can help you save money while still keeping your home warm.

It’s also important to remember the basics of budgeting and financial planning. By creating a budget and tracking your expenses, you can make sure that you’re spending within your means and finding ways to save money. Knowing where your money is going is key to making the most of your income and finding areas where you can cut back.

While it may be tempting to spend money on takeaways or other miscellaneous items, it’s important to prioritize your spending. Make sure that you’re taking care of your essential needs, such as heating your home, before spending on non-essential items. By prioritizing and making smart spending choices, you can ensure that you have enough money to cover your heating costs.

If you’re struggling to cover your heating costs or other expenses, don’t hesitate to seek help. There are organizations and charities that provide assistance to those in need. They can help you navigate the process of applying for financial assistance and can provide guidance and support. Remember, asking for help is a sign of strength, and there are resources available to help you.

In conclusion, when it comes to heating your home during the cold weather months, there are options available to help cover the costs. From the Cold Weather Payment to other discounts and assistance programs, it’s important to know what you’re eligible for and take advantage of the support that’s available. By planning your budget and making smart financial choices, you can ensure that you stay warm while also keeping your finances in good shape.