Managing your finances can sometimes feel like a daunting task. With so many expenses to keep track of – from bills to employee payments – it’s easy to lose sight of where your money is going. That’s where an expense sheet comes in handy. By creating a simple spreadsheet or using templates available online, you can easily categorize and track your expenses in real-time.

One of the first steps in creating an expense sheet is to determine the categories that are most relevant to your financial needs. Whether it’s individual budgeting or company expense tracking, categorizing your expenses will help you get a clearer picture of how much you’re spending in each area. Some common categories include daily expenses, transportation, utilities, and entertainment.

While there are different templates and worksheets available, it’s always a good idea to create your expense sheet from scratch. This way, you can customize it to fit your specific needs and ensure that it covers all the necessary information. From the flow of income and expenses to any transfers or reimbursements, your expense sheet should reflect the financial management of your unique situation.

Once you have your expense sheet ready, it’s time to start filling it in. Make it a habit to enter each transaction as soon as possible, whether it’s an outgoing payment or incoming revenue. This way, you can stay on top of your finances and have a clear picture of where your money is going. For instance, if you’re going on a business trip, make sure to document all the expenses incurred during the trip, including meals, accommodation, and transportation.

A top tip for using an expense sheet effectively is to always categorize your transactions. This will not only help you stay organized but also make it easier to generate reports and track your spending on a month-by-month basis. For instance, if you have resale expenses, you can create a category specifically for those, allowing you to easily see how much you’ve spent on resale over certain months.

In conclusion, creating an expense sheet is an essential step in financial management. By tracking your expenses and categorizing them, you can easily identify areas where you may be overspending and make necessary adjustments. Whether you prefer a simple worksheet or a more advanced tool like Smartsheet, having an expense sheet in place will certainly help you stay on top of your finances and make informed decisions about your money.

Expense Sheet Templates

When it comes to keeping track of your company’s expenses, having a system in place is essential. That’s where expense sheet templates come in handy. These templates allow you to easily categorize and record your financial transactions, making it easier to stay within budget and show a clear picture of your company’s cash flow.

Using expense sheet templates can be a simple and effective way to track your income and expenses on a month-by-month basis. Whether you’re a small business owner, self-employed individual, or even just trying to keep track of personal expenses, these templates can help you stay organized and on top of your financial needs.

There are many different expense sheet templates to choose from, depending on your specific needs. Some templates are designed for tracking expenses related to a certain trip or project, while others can be used for general budgeting purposes. Regardless of which template you choose, the basic steps for using them are the same.

First, you’ll need to download an expense sheet template that works for you. There are many free options available online, including those from popular financial software companies like Intuit and Smartsheet. Once you have the template downloaded, open it up and start filling in the necessary information.

Each template will have different categories for you to input your expenses into, such as transportation, meals, and office supplies. It’s important to be as detailed as possible when describing each expense, as this will help with tracking and reimbursement if necessary.

Once you have all of your expenses entered into the template, you can transfer them to a master expense sheet or financial statement. This will allow you to see the total amount spent within each category, as well as your overall revenue for the month.

Using expense sheet templates not only helps you keep track of your company’s expenses, but it can also provide valuable insight into your spending habits. By categorizing your expenses and seeing them in real-time, you can identify areas where you may be overspending or where you can cut back.

Overall, expense sheet templates are a valuable tool for any business or individual looking to better manage their finances. They provide an easy and organized way to track expenses and stay within budget, while also giving you a clear picture of your financial health. Whether you go with a simple template or a more complex one, having an expense sheet in place is always a good idea.

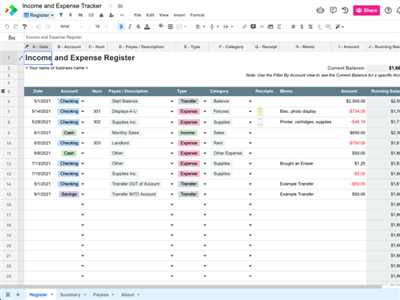

Income and Expense Tracker Template

An income and expense tracker template is a useful tool for individuals and small businesses to easily track and manage their financial transactions. With this template, you can create worksheets that categorize your income and expenses, making it easy to see where your money is going.

The template works in real-time, so as you enter your income and expenses, it automatically calculates your revenue and displays a comprehensive picture of your financial health. Whether you’re tracking your personal expenses or reimbursing employees for business expenses, this template is a simple and intuitive way to stay on top of your finances.

The income and expense tracker template allows you to categorize your transactions, which is particularly useful for tax purposes and budgeting. For instance, you can create categories for bills, transportation expenses, meals, and more. By categorizing your expenses, you can easily see how much you’re spending in each category and whether you need to make any adjustments.

One of the key features of this template is the ability to track expenses on a daily, monthly, or trip-by-trip basis. For individual users, this means tracking daily expenses and creating a month-by-month overview of your spending. For small businesses, this feature allows you to track expenses for each trip and create individual reports for reimbursement or resale purposes.

The income and expense tracker template is easy to use and can be customized to suit your specific needs. It’s compatible with popular spreadsheet programs like Microsoft Excel and Google Sheets, so you can easily import and export data from different sources.

In summary, the income and expense tracker template is a powerful tool for anyone looking to stay on top of their finances. Whether you’re tracking personal expenses or managing a small company, this template provides a simple and intuitive way to track, categorize, and report your income and expenses. With its easy-to-use interface and comprehensive tracking capabilities, it’s the perfect solution for anyone looking to take control of their financial situation.

Create income and expense categories

When managing your individual or small business expenses, it’s important to have a clear understanding of where your money is coming from and where it’s going. By categorizing your income and expenses, you can easily track and analyze your financial flow.

One of the easiest ways to categorize your income and expenses is by using worksheets or templates. If you’re using a financial management software like Intuit, you may already have pre-defined categories that you can use. However, if you’re just starting out or prefer a more intuitive approach, creating your own categories can be a helpful step.

Start by listing all the different income sources and types of expenses you have. For instance, your income categories can include revenue from sales, resale, or even certain transactions like reimbursement from a business trip. On the other hand, your expense categories can include payments for rent, utilities, employee salaries, and more.

Next, create a table or download a template that allows you to categorize each income and expense transaction. Within this table, you can include columns for the date, description of the transaction, category, amount, and whether it’s an income or expense.

By categorizing your income and expense transactions, you can stay organized and make it easier to track your financial progress. For instance, if you want to see how much you’ve spent on office supplies each month, you can simply filter the table by the “expense” category and the “office supplies” subcategory.

Creating income and expense categories can also be useful for company budgeting. By categorizing your expenses, you can easily see where your money is going and make necessary adjustments. This can be especially helpful if you’re looking to cut costs or increase certain revenue streams.

Using tools like smartsheet or Excel can make it even easier to categorize and track your income and expenses in real-time. With these tools, you can create automated formulas and reports that show you the total income and expenses within each category.

Remember, the key to effective income and expense tracking is to consistently categorize your transactions. It may take some time and effort to set up your categories initially, but once you’ve done so, it will be much easier to enter and organize your financial data. Whether you’re an individual or a small business owner, having well-defined income and expense categories can help you stay on top of your finances and make informed financial decisions.

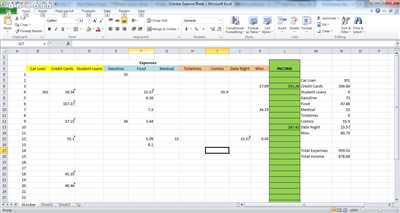

Income and Expense Worksheet

Tracking your income and expenses is an essential part of managing your personal or business finances. An Income and Expense Worksheet is a useful tool that allows you to keep a record of your financial transactions in a structured format. Whether you’re a small business owner, a professional freelancer, or someone who wants to stay on top of their personal finances, a worksheet can help you maintain a clear and accurate picture of your financial situation.

With an Income and Expense Worksheet, you can categorize your income and expenses into different groups, such as revenue from resale, transfer payments, or reimbursement for expenses. By categorizing your transactions, you can easily see where your money is coming from and where it’s going. This makes it easier to track your cash flow and identify areas where you may be spending too much.

Using a worksheet also allows you to record a description of each transaction, which can be helpful for future reference. For instance, you can note whether a certain expense was necessary or avoidable, or you can indicate the purpose of a certain income source. This level of detail can be invaluable when it comes to budgeting and financial planning.

An Income and Expense Worksheet can be as simple or as detailed as you need it to be. You can create your own template or use one of the many available online. Smartsheet, for instance, offers top-notch templates that can help you get started. The important thing is to find a format that works for you and stick to it consistently.

By using an Income and Expense Worksheet, you can also make it easier to track transactions over time. Instead of relying on memory or sifting through piles of receipts, you can input your income and expenses into the worksheet on a daily or monthly basis. This real-time tracking allows you to stay on top of your financial needs and make informed decisions about your money.

Whether you’re working with a team or managing your finances solo, an Income and Expense Worksheet can help you stay organized. For employees, it’s an easy way to ensure that everyone is on the same page and that expenses are properly reimbursed. For freelancers or small business owners, it provides a clear picture of your financial health and can help you make strategic decisions.

In summary, an Income and Expense Worksheet is a valuable tool for anyone who wants to effectively manage their finances. It allows you to track your income and expenses, categorize transactions, and provide a detailed description of each transaction. With the help of a worksheet, you can stay on top of your bills, manage your cash flow, and make smarter financial decisions. So, whether you’re going on a trip or running a company, an Income and Expense Worksheet is certainly worth considering.

Download

When it comes to creating an expense sheet, it’s always a good idea to start with a template. There are many different templates available that you can use to create your own expense sheet. Some companies provide their own budgeting sheets for employees, or you can find templates online.

One option is to use a downloadable worksheet, such as the one provided by Intuit. This worksheet allows you to track your expenses month-by-month and even transfer data from one month to the next. With real-time tracking, you can see how much you’ve spent in different categories and intuitively manage your budget.

If a downloadable worksheet doesn’t suit your needs, you can also try using a software like Smartsheet. This software allows you to create your own expense tracking sheet, customized to your company’s specific requirements. It’s easy to categorize your expenses and stay organized.

Whether you choose to use a template or create your own expense sheet, it’s important to make sure that you’re tracking all the necessary information. For each expense, include the date, a description, the amount spent, and any relevant pictures or documents. This makes it easier to reference your expenses later on and can be especially helpful when preparing a trip report or expense statement.

Once you have your expense sheet set up, you can download it and start using it right away. By sticking to a consistent system for expense management, you’ll not only stay on top of your company’s financial flow, but also make it easier to track expenses on a daily basis.

Remember, the purpose of an expense sheet is to categorize and track all the expenses your company incurs. This can include anything from office supplies to travel expenses to resale transactions. By keeping a detailed record of your expenses, you’ll have a clear picture of where your company’s money is going and whether you’re staying within your budget.

So, download a simple expense sheet template or create your own, and start tracking your company’s expenses today!

Description

When it comes to managing your expenses, having an expense sheet can be a handy tool. An expense sheet is essentially a detailed record of all your financial transactions, including the money you’ve spent and the income you’ve earned. It allows you to track your expenses month by month, which not only helps you stay on top of your budgeting, but also gives you a clear picture of where your money is going.

Creating an expense sheet may seem like a daunting task at first, but with the right tools and templates, it can be much easier than you think. One instance where you might certainly need an expense sheet is during a business trip. Keeping track of your payments and expenses during the trip can help you with reimbursement and provide a comprehensive report to your management.

There are various ways to create an expense sheet, but using spreadsheet software like Microsoft Excel or Google Sheets is a popular choice. These software programs provide intuitive worksheets that allow you to easily input your financial data and categorize your expenses. They also offer helpful features such as built-in formulas and functions that can automatically calculate totals and generate reports.

Another option is to download pre-made expense sheet templates from websites like Smartsheet or Intuit. These templates are designed to make expense tracking a breeze, with predefined categories and formulas already set up. All you have to do is enter your expenses and income, and the template will do the rest of the work for you.

When creating an expense sheet, it’s important to think about the specific categories and columns that will be necessary for your tracking. Common categories include meals, transportation, accommodation, and entertainment. You may also want to include categories for personal expenses, bills, and any other specific expenses that are relevant to your situation.

Once you have your expense sheet set up, it’s important to stay consistent with your tracking. Make a habit of entering your expenses daily or as soon as possible after the transaction occurs. This will ensure that your expense sheet is always up to date and accurate.

A good expense sheet can also serve as a reference for future planning. By looking at your past expenses, you can get a better idea of how much you typically spend in different categories and adjust your budget accordingly. This can help you make more informed financial decisions and stay on top of your financial goals.

So, whether you’re an individual looking to manage your personal finances or a business owner who needs to track expenses for tax and financial reporting purposes, having an expense sheet is a valuable tool. With the right template and consistent tracking, you’ll have a clear picture of where your money is going and how to stay within your budget.

Stay on Top of Company Expenses with Real-Time Work Management in Smartsheet

Managing company expenses effectively is crucial for financial stability and growth. With Smartsheet, you can easily track and categorize your expenses in real-time, making it easier than ever to stay on top of your company’s financial picture.

Smartsheet’s intuitive interface allows you to create and customize expense sheets and templates that suit your business needs. You can track income and expenses, categorize transactions, and even transfer data from other financial software, such as Intuit QuickBooks. This means that you can have a complete and up-to-date picture of your company’s revenue and expenses, all in one place.

One of the key features of Smartsheet is its ability to show you not only the individual expenses but also how they relate to your overall budget. This allows you to see where your money is being spent and whether you’re staying within your financial goals. By categorizing expenses and linking them to specific projects or clients, you can easily see how much you’ve spent on a particular trip or an employee’s expenses.

Tracking expenses is as simple as creating a new sheet and adding the necessary information. You can include a description of the expense, the date it occurred, the amount spent, and any other relevant details. Smartsheet also allows you to attach receipts and other supporting documents, making it easy to keep everything organized.

Smartsheet’s real-time work management capabilities mean that you can access your expense sheets from anywhere and collaborate with your team in real-time. If certain employees are responsible for tracking their own expenses, they can update the relevant sheets directly, saving you time and effort.

When it comes time to report on your expenses, Smartsheet makes it easy to generate comprehensive reports. You can customize these reports to show only the data that’s most important to you, such as expenses by category or by month. You can also download the reports in different formats, such as PDF or Excel, and share them with stakeholders or use them for reference.

With Smartsheet’s real-time work management, you can stay on top of your company’s expenses and make more informed financial decisions. Whether you’re a small business owner, a project manager, or a finance professional, Smartsheet can help you streamline your expense tracking and ensure that your finances are in order.

| Benefits of Smartsheet for Expense Management |

|---|

| Real-time tracking of income and expenses |

| Easy categorization and linking of transactions |

| Ability to transfer data from other financial software |

| Customizable sheets and templates |

| Attachment of receipts and other supporting documents |

| Access and collaboration from anywhere |

| Generate and customize comprehensive reports |

| Download reports in various formats |