Investing in dividend stocks can be a smart strategy for those looking to generate a steady stream of income. Companies that pay dividends are often seen as more stable and reliable, making them a popular choice for investors who want to balance the risk and reward in their portfolio. One of the key benefits of dividend-paying stocks is that they tend to be less volatile than growth stocks, especially during times of market uncertainty or economic downturns.

Stanley Morgan, for instance, has a long track record of consistently paying dividends. The company has even increased its dividend payout for 25 consecutive years, making it a trusted choice for income-seeking investors. By investing in dividend stocks, you not only have the potential to receive regular cash payments, but you also benefit from the potential for capital appreciation. This is especially true if the company increases its dividend payout over time, as this can help boost the overall return on your investment.

When building a dividend portfolio, it’s important to consider both the yield and the growth potential of the stocks you choose. A higher dividend yield may be attractive in the short term, but if the company is not able to sustain or grow its dividend payout over time, your income may be at risk. On the other hand, a lower-yielding stock with a history of consistent dividend growth may provide a higher overall return in the long run. It’s all about finding the right balance between current income and future growth.

One strategy for building a dividend portfolio is to focus on dividend-paying stocks from different sectors. Diversifying your investments across various industries can help manage risk and reduce the impact of any single sector or company performance. Additionally, you may want to consider investing in companies that have a history of consistently raising their dividends, as this is often a sign of a healthy and well-managed business.

Overall, creating a dividend portfolio can be a rewarding investment approach, particularly for those looking to generate income during retirement or build wealth over time. By carefully selecting dividend-paying stocks and balancing your portfolio with a mix of different sectors, you can create a reliable and attractive source of income for years to come.

How To Series: How to Build a Dividend Portfolio and Receive a Side Income

When it comes to investing, having a portfolio that generates a steady side income can be a smart strategy. One way to achieve this is by building a dividend portfolio. Dividends are payments made by companies to their shareholders as a share of their profits. By investing in dividend-paying stocks, you can receive regular income payments, often on a quarterly basis.

So, how do you build a dividend portfolio? Here are some steps to help you get started:

1. Research and Select Dividend-Paying Stocks

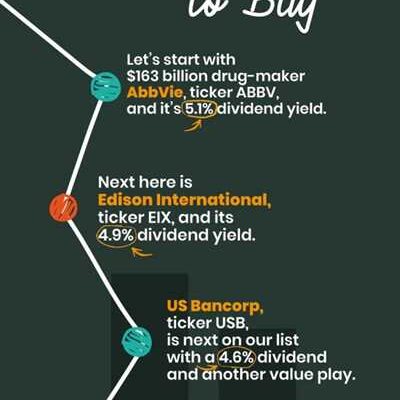

Begin by researching different stocks and sectors that have a history of paying dividends. Look for companies with a solid track record of consecutive dividend payments and a history of increasing their dividends over time. Some popular dividend-paying sectors include utilities, consumer staples, and real estate investment trusts (REITs).

2. Balance Your Portfolio

When building your dividend portfolio, it’s important to diversify your investments across different sectors and stocks. This helps to spread the risk and can improve the stability of your portfolio. Aim for a mix of high-yield dividend stocks and stocks with lower yields but higher potential for growth.

3. Consider the Dividend Yield

The dividend yield is a measure of a company’s annual dividend payments relative to its stock price. It’s calculated by dividing the annual dividend per share by the stock’s current price. A higher dividend yield can be attractive, but be cautious of extremely high yields, as they may indicate financial instability.

4. Open an Investment Account

To invest in dividend-paying stocks, you’ll need to open an investment account with a brokerage firm. There are many online brokers available that offer convenient platforms for buying and selling stocks. Research different brokers to find one that suits your needs and offers competitive fees.

5. Invest and Reinvest Dividends

Once you have selected your dividend stocks and opened an investment account, you can start investing. Consider setting up a dividend reinvestment plan (DRIP) that allows your dividends to be automatically reinvested in additional shares of the same company. This can help to compound your returns over time.

6. Monitor, Review, and Adjust

Regularly monitor the performance of your dividend portfolio and review your investments. Keep an eye on any changes in a company’s financial health, dividend payout ratio, or market conditions that may warrant adjustments to your portfolio. Stay informed through reliable sources and be prepared to make changes as needed.

By following these steps, you can build a dividend portfolio that generates a side income and potentially provides for your retirement years. Remember, investing in dividend-paying stocks comes with risks, so it’s important to do your own research and diversify your portfolio.

How to Invest in Dividend Stocks for Retirement

When building a retirement portfolio, it’s important to include investments that provide a steady stream of income. Dividend stocks can be a key component of this strategy, as they allow you to receive regular payments from the companies you invest in.

Dividend stocks are shares of a company that pay out a portion of their profits to shareholders on a regular basis. These payments, known as dividends, can be a reliable source of income in retirement. Many dividend-paying companies have a long history of consecutive dividend increases, making them attractive investments for income-focused investors.

Dividend stocks typically offer higher yields than other types of investments, such as bonds or savings accounts. This can provide retirees with a steady income stream that can help offset the higher cost of living in retirement.

When investing in dividend stocks, it’s important to diversify your portfolio. By spreading your investments across different sectors, you can reduce the risk of being heavily impacted by the performance of a single sector or company. This can help ensure that you have a more stable and balanced portfolio.

Dividend stocks can be found in nearly every sector of the stock market. For instance, companies in the technology sector, such as Apple and Microsoft, also pay dividends. By including dividend-paying stocks from different sectors in your portfolio, you can benefit from both the income and potential growth of these companies.

One way to identify potential dividend stocks is to look for companies with a history of increasing their dividends over time. Companies like Johnson & Johnson and Procter & Gamble have consistently increased their dividends for many years. This demonstrates their commitment to returning value to shareholders.

Another strategy is to look for companies with a high dividend yield. The dividend yield is calculated by dividing the annual dividend payment by the stock price. A higher yield indicates that you will receive more income relative to the cost of your investment.

While dividend stocks can be a good source of income in retirement, it’s important to note that they carry some risks. Just like any investment, the value of a dividend stock can fluctuate. Additionally, companies may reduce or suspend their dividend payments during times of financial difficulty.

To help mitigate these risks, it’s important to diversify your dividend stock investments and invest in companies that have a solid financial position and a history of consistent dividend payments. Companies like Coca-Cola and Johnson & Johnson, for instance, are often considered reliable dividend investments.

In conclusion, investing in dividend stocks can be a smart strategy for retirement. They provide a reliable source of income and the potential for capital appreciation. By carefully selecting a diversified portfolio of dividend-paying stocks, you can build a retirement portfolio that helps meet your income needs and provides peace of mind.

| Sector | Dividend-Paying Stocks |

|---|---|

| Consumer Staples | Procter & Gamble, Coca-Cola |

| Healthcare | Johnson & Johnson, Pfizer |

| Technology | Apple, Microsoft |

Which sectors typically pay dividends

When it comes to building a dividend portfolio, it’s important to consider which sectors typically pay dividends. Dividend-paying stocks can be a great addition to your investment strategy, especially if you’re looking for a source of consistent income.

Some sectors tend to be more attractive for dividend investors than others. For instance, utilities, consumer staples, and real estate investment trusts (REITs) are known for their relatively stable and consistent dividend payouts. These sectors often have regulated business models or long-term lease agreements that provide a steady stream of income.

Financial institutions, such as banks and insurance companies, also tend to pay dividends. They can be especially attractive during times of economic growth, when their profits increase and they have more capital to distribute to shareholders.

Technology companies, on the other hand, are generally not known for their dividends. Many tech companies reinvest their earnings back into the business for growth and innovation. However, this doesn’t mean that all tech stocks don’t pay dividends. Companies like Apple and Microsoft have started to pay dividends in recent years, making them more appealing to income-focused investors.

Another sector that typically pays dividends is healthcare. Pharmaceutical companies, for example, often have a series of consecutive dividend payments and provide a source of stability in a portfolio.

It’s worth noting that high dividend yields can sometimes indicate a higher level of risk. A company may have a high dividend yield because its stock price has dropped significantly, and the dividend yield is calculated based on that lower price. So, it’s important to balance the desire for higher yields with the potential risk that comes with them.

In conclusion, if you’re looking to build a dividend portfolio, consider investing in sectors that tend to pay dividends. Utility, consumer staples, REITs, financial institutions, and healthcare companies are just a few examples of sectors that generally offer dividend-paying stocks. However, always do your own research and assess the individual companies and their dividend policies before making any investment decisions.

Balancing Risk and Return

When building a dividend portfolio, it’s important to strike a balance between the potential for higher returns and the associated risks. Dividend-paying stocks tend to be more stable and often have lower price volatility compared to growth stocks. This makes them attractive for investors seeking steady income, especially during retirement.

However, it’s worth noting that dividend stocks are not without their risks. For instance, companies may lower or eliminate their dividends during times of economic downturn or financial difficulties. It’s crucial to diversify your portfolio across different sectors and companies to mitigate this risk.

One strategy to help balance risk and return is to invest in dividend-paying stocks that have a history of consistently increasing their dividends over a series of consecutive years. These companies, often referred to as “dividend aristocrats,” are considered more reliable dividend payers. They have demonstrated their commitment to returning value to shareholders and have proven their ability to generate consistent income.

Dividend yield is another important factor to consider when balancing risk and return in your portfolio. This metric measures the annual dividend payments a company makes as a percentage of its stock price. Generally, higher dividend yields can indicate a more attractive investment opportunity. However, it’s important to assess the sustainability of the dividend payout and the overall financial health of the company before making any investment decisions.

Investing in a diversified portfolio of dividend-paying stocks can help you mitigate risk while still seeking competitive returns. By spreading your investments across different sectors and companies, you can reduce the impact of any single company’s poor performance. This approach also allows you to take advantage of growth opportunities in different sectors of the economy.

To build your dividend portfolio, start by creating a list of dividend-paying stocks that meet your investment criteria. Consider factors such as dividend yield, dividend growth rate, and the stability of the company’s financials. Research different sectors and identify companies that have a strong track record of paying dividends.

Keep in mind that dividend investing requires a long-term perspective. Dividends are typically paid out quarterly or annually, and it can take time to accumulate a significant income stream from your investments. Patience and discipline are key to achieving your investment goals.

In conclusion, balancing risk and return is crucial when creating a dividend portfolio. By carefully selecting dividend-paying stocks and diversifying your investments, you can potentially earn a steady income while managing the inherent risks that come with investing in the stock market.

Источники

There are several sources investors can consider when building a dividend portfolio. Dividend-paying stocks, also known as income stocks, are one of the most common sources. These are shares of publicly traded companies that have a track record of paying regular dividends to their shareholders. Dividend stocks tend to be in more stable and mature sectors, which tend to offer lower growth rates but potentially higher yields.

Another source of dividend income is dividend-focused mutual funds or exchange-traded funds (ETFs). These funds typically invest in a series of dividend-paying stocks, providing investors with immediate diversification and income. They can be an attractive option for investors looking for a more hands-off approach to investing in dividend stocks.

For those who want to take a more active role in managing their dividend portfolio, individual bonds can also be a source of income. Bonds are debt instruments issued by companies or governments, and they often pay regular interest payments to their investors. While the interest rates on bonds tend to be lower than the dividend yields of stocks, they also tend to be less risky.

Real estate investment trusts (REITs) are another option for dividend investors. These companies own and operate income-producing properties, such as apartment buildings, office spaces, or shopping centers. REITs are required by law to pay out a majority of their taxable income to shareholders in the form of dividends, making them attractive for dividend-focused investors.

Dividend options can also be found in other investment vehicles, such as certificates of deposit (CDs) or money market accounts. While these options may not offer the same potential for growth as stocks or bonds, they provide a stable and low-risk source of income.

Finally, some investors may choose to invest in dividend-paying companies outside of their retirement accounts. This can help to balance investment income with income from other sources, such as Social Security or pension payments, during retirement.