If you are looking to start your investment portfolio, it is important to understand the basics of portfolio management. Having a well-diversified investment portfolio can help you achieve your financial goals and build long-term wealth. In this article, we will guide you through the steps of starting a portfolio and provide you with some tips to get started.

1. Determine your financial goals: Before you start investing, it is important to determine your financial goals. This will help you choose the right investment strategy and make informed decisions about your portfolio. Are you looking to save for retirement, buy a house, or fund your children’s education? Knowing your goals will guide you in selecting the appropriate investments.

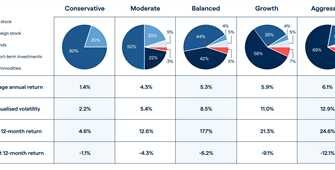

2. Assess your risk tolerance: Understanding your risk tolerance is crucial when building an investment portfolio. Your risk tolerance is your ability to handle fluctuations in the market and potential losses. Some investors have a higher risk tolerance and are comfortable with more volatile investments, while others prefer a low-risk portfolio with more stable returns.

3. Research and choose your investments: Once you have determined your financial goals and assessed your risk tolerance, it’s time to research and choose your investments. There are various types of investments to consider, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Consider the specific benefits and risks of each investment and their suitability for your portfolio.

4. Consult with a financial adviser: If you are not confident in making investment decisions on your own, consider consulting with a financial adviser. A financial adviser can provide you with expert advice and help you create a personalized investment plan based on your goals and risk tolerance. They can also help you make adjustments to your portfolio as needed and keep you informed about market news and trends.

5. Monitor and adjust your portfolio: Once you have started your portfolio, it is important to regularly monitor and adjust it as needed. Review your portfolio at least once a year to ensure it aligns with your financial goals and risk tolerance. Keep track of any changes in the market or your personal circumstances that may require adjustments to your investments.

Remember to stay committed to your long-term investment plan and avoid making impulsive decisions based on short-term market fluctuations. Building a portfolio takes time and patience, but with the right strategies and proper management, you can achieve your financial goals and build a bright future.

STARt Phantom – Free Portfolio Website

If you’re wondering how to start a portfolio, STARt Phantom is the perfect solution for you. STARt Phantom is a free website that allows you to build and showcase your portfolio online. Whether you’re an individual looking to showcase your work or a business in need of an online presence, STARt Phantom has got you covered.

To obtain a STARt Phantom portfolio website, you will need to follow a few simple steps. First, visit the STARt Phantom website and click on the “Sign Up” button. You will then need to fill out a registration form with your personal details and create a username and password for your account.

After signing up, you will be directed to the dashboard of your portfolio website. Here, you can customize the look and feel of your website by selecting from a range of pre-designed templates and color schemes. Simply click on the “Settings” tab to access these options.

STARt Phantom is a Shariah-compliant investment program provided by Baraka Corporation, a third-party provider. Baraka Corporation does not endorse or offer any guarantee of security or profit on your investments.

All investments carry a certain degree of risk, including the loss of principal. Before making any investment decisions, it’s important to obtain advice from a qualified financial adviser who can provide you with a personalized investment plan based on your goals and risk tolerance.

STARt Phantom portfolios are screened according to Shariah principles, which means that certain investments such as those related to alcohol, gambling, or other prohibited activities will be excluded.

By using STARt Phantom, you can showcase your work or business in a professional and visually appealing way. The website offers a range of features and benefits, including stock and news updates, portfolio performance tracking, and the ability to connect with other professionals and potential clients through social media.

To access these features and start building your portfolio, simply log in to your STARt Phantom account and navigate to the relevant sections of the website. From there, you can add portfolio items, write project descriptions, and upload images or videos to showcase your work.

In conclusion, STARt Phantom is a free portfolio website that can help you build a professional online presence for your work or business. With its user-friendly interface and customizable options, STARt Phantom makes it easy for anyone to create a stunning portfolio website to impress potential clients and employers.

Looking for something specific

If you are looking for something specific on your portfolio website, such as a specific color scheme or lettering style, you can customize these elements to suit your preferences. Whether you are building your own portfolio website or using a provided platform or service, you may have the option to make these adjustments.

To customize the colors and fonts on your portfolio website, you will usually need to access the settings or design options section of your website builder. Here, you can make changes to the overall appearance of your site, including the colors and fonts used in different parts of the design.

If the website builder or platform you are using does not offer built-in customization options for colors and fonts, you may need to modify the HTML and CSS code directly. This may require some knowledge of coding and web development, or you can hire a web developer to make these changes for you.

When customizing the colors and fonts on your portfolio website, it is important to consider your specific goals and the overall message you want to convey. Certain colors and fonts can evoke different emotions and associations, so choose options that align with your personal brand and the impression you want to make on visitors.

In addition to customizing the colors and fonts, you may also have the option to customize other aspects of your portfolio website. This can include the layout and structure of the pages, the inclusion of contact information and a statement of your general goals, and the integration of other financial or agency-related information.

If you decide to invest in stocks, funds, or other financial products through your portfolio website, it is important to do thorough research and consider the risks and benefits. You should consult with a financial advisor or other trusted expert to ensure that your investments align with your goals and financial situation.

Some portfolio website providers may offer specific investment programs or savings accounts that can help you build funds over time. These programs may have certain limitations and restrictions, so be sure to read the terms and conditions before committing to any investment or savings plan.

Lastly, it is important to remember that no website or financial provider can guarantee a specific rate of return or protection against loss. Investments and financial decisions always carry a degree of risk, and it is important to make informed choices based on your own research and risk tolerance.

If you have any specific questions or concerns about a particular feature or customization option on your portfolio website, reach out to the customer support or contact information provided by your website builder or platform. They should be able to assist you in navigating the available options and making the adjustments you desire.

In conclusion, when looking for something specific on your portfolio website, such as custom colors, fonts, or other design elements, take the time to explore the options and settings provided by your website builder or platform. If necessary, consult with a web developer or expert to ensure that your website reflects your goals and preferences.

Build your investment portfolio with Baraka

Are you looking to start investing but don’t know where to begin? Baraka is here to help. Baraka is a financial company based in Dubai, offering a marketplace where you can build your investment portfolio. Whether you are an experienced investor or just starting out, Baraka can provide the guidance and tools you need to make informed investment decisions.

One of the key benefits of investing with Baraka is that their investments are screened to ensure they comply with Shariah principles. This means that you can invest without compromising your beliefs. Baraka also offers a guarantee on their investments, so you can have peace of mind that your portfolio is in safe hands.

To start building your portfolio, open an account with Baraka. You can do this easily through their website by clicking on the “Open Account” button. Once you have created an account, you will be assigned a personal adviser who will help you determine your financial goals and guide you in selecting the right investments for your portfolio.

Baraka provides a wide range of investment options, including stocks, bonds, and mutual funds. Their website is user-friendly, allowing you to navigate through different investment opportunities and access the latest news on the market. You can also customize your portfolio based on your risk tolerance and investment preferences.

If you are unsure where to start, Baraka can help. Their team of experienced financial advisers can analyze your financial situation and provide personalized investment recommendations. They will work with you to develop a portfolio that aligns with your goals and helps you achieve financial success.

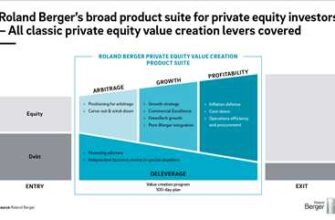

Baraka understands that every client is unique, so they offer tailored solutions to meet your individual needs. Their investment solutions are backed by rigorous research and analysis, ensuring you are making informed investment decisions. Baraka’s state-of-the-art technology and dedication to customer service make them the ideal partner for all your investment needs.

To get started with Baraka, visit their website and click on the “Open Account” button. After providing the necessary information, you will need to authenticate your account. Once you have done this, you can proceed to set your investment preferences by clicking on the “Settings” icon on the screen. In the Settings section, you can choose the color scheme and set other preferences for your portfolio.

Baraka offers a seamless and hassle-free investment experience. Their user-friendly platform allows you to monitor your portfolio, view your investment statements, and make adjustments to your holdings whenever you like. If you have any questions or need assistance, you can contact Baraka’s customer support team through their provided contact information.

Don’t miss out on the opportunities in the market. Start your investment journey with Baraka today and build a bright financial future.

How can a financial adviser help me

A financial adviser can help you in a number of ways when it comes to managing your portfolio and making investment decisions. Whether you are an individual or a corporation looking to grow your investments, a financial adviser can provide valuable expertise and guidance.

One of the main benefits of working with a financial adviser is that they can help you develop a customized investment plan based on your specific financial goals and risk tolerance. They will take the time to understand your needs and objectives, and then recommend appropriate investment strategies to help you achieve them.

In addition to creating a personalized investment plan, a financial adviser can also help you analyze the current market conditions and identify potential investment opportunities. They stay up-to-date with the latest news and trends in the financial world, allowing them to provide you with valuable insights and recommendations.

Furthermore, a financial adviser can help you navigate through complex investment products and options. They understand the intricacies of the financial marketplace and can explain to you the advantages, disadvantages, and risks associated with different investment vehicles. This knowledge will empower you to make informed decisions about your portfolio.

If you are looking to invest in accordance with Shariah principles, a financial adviser can also guide you towards Shariah-compliant investment options. They understand the specific requirements of Islamic finance and can help you choose investments that align with your beliefs and values.

A financial adviser can also assist you in monitoring the performance of your investments. They will regularly review your portfolio and make adjustments as necessary to keep your investments on track towards meeting your goals. They can help you identify potential risks and mitigate them, while also taking advantage of opportunities that may arise.

Another important role that a financial adviser plays is helping you manage risk. They will assess your risk tolerance and help you develop a diversified portfolio that balances potential returns with the level of risk you are comfortable with. This can help protect your investments from market volatility and minimize potential losses.

In summary, a financial adviser can provide you with the expertise, knowledge, and guidance you need to make informed investment decisions and achieve your financial goals. They can tailor a portfolio that aligns with your specific needs and objectives, while also helping you navigate the complexities of the financial marketplace. Whether you are an individual or a corporation, a financial adviser can help you optimize your investments and achieve long-term financial security.

Sources

When it comes to building your portfolio, there are various sources you can rely on for information and guidance. Here are a few key sources to consider:

- Financial news websites: Websites like Bloomberg and CNBC provide up-to-date news and analysis on the market, economy, and specific investments. It’s a great place to stay informed about the latest trends and events.

- Investment providers: Whether you’re looking to invest in stocks, funds, or other assets, investment providers offer a wide range of options and resources. They can help you choose the right investment for your goals and provide research and analysis on different opportunities.

- Financial advisors: If you’re not sure where to start or need personalized advice, working with a financial advisor can be a good option. They can assess your financial situation, understand your goals, and recommend suitable investments based on your risk tolerance and time horizon.

- Online forums and communities: Joining online communities and forums focused on investing can offer valuable insights and perspectives from experienced investors. You can learn from others, ask questions, and get recommendations on specific investments.

- Company filings and reports: If you’re interested in investing in specific companies, reviewing their annual reports, quarterly filings, and other financial disclosures can provide detailed information about their financial health, performance, and prospects.

- Government websites: Government agencies like the Securities and Exchange Commission (SEC) provide important information about regulations, investor protection, and market trends. Their websites can be a valuable resource for understanding the legal and regulatory aspects of investing.

Remember to always do your own research and consider multiple sources before making any investment decisions. Different sources may have different perspectives and biases, so gathering information from a variety of sources can help you make well-informed choices.