If you’re looking to make online payments or receive money for your business, opening a PayPal account is a wise step. PayPal is a popular online payment platform that lets you send and receive payments easily. In this step-by-step guide, we will walk you through the process of opening a PayPal account and verifying it.

Step 1: Sign up for a PayPal Account

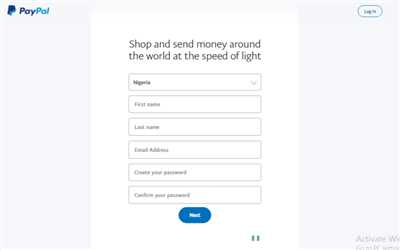

To start, go to the PayPal website at paypal.com and click on the “Sign Up” button. You will be presented with two options: “Personal Account” or “Business Account”. Choose the type of account that best suits your needs. If you’re an individual looking to make online purchases, a personal account will be sufficient. If you have a business and want to receive payments from customers, choose the business account option.

Step 2: Enter Your Information

After picking the account type, you will need to provide your email address, create a password, and enter your personal or business information. Make sure to enter accurate information as PayPal will use this to verify your account. Once you’ve entered all the required details, click on the “Agree and Create Account” button.

Step 3: Verify Your Account

After creating your account, PayPal will send a verification code to the email address you provided. Go to your email inbox, find the email from PayPal, and enter the verification code on the PayPal website. This step is required to confirm that the email address you provided is valid.

Step 4: Link a Payment Method

The next step is to link a payment method to your PayPal account. You can link your bank account, debit card, or credit card to make payments through PayPal. To link a payment method, go to your PayPal account settings and click on “Link a card or bank”. Follow the instructions provided to add your payment method.

Step 5: Set Up Your PayPal Account

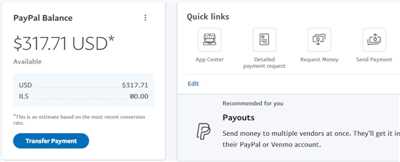

Once you have successfully linked a payment method, you can set up your PayPal account according to your preferences. You can choose the default currency, payment notifications, and other settings to make your PayPal experience more personalized. Take a few moments to review and adjust these settings to suit your needs.

That’s it! You have successfully opened a PayPal account. Now you can start sending and receiving money online, making purchases, and withdrawing funds to your linked payment method. Keep in mind that PayPal has certain limits on the amount you can send or receive, depending on the type of account you have and the level of verification you have completed. Read through the PayPal website or consult their customer support for more information on these limits.

- How to set up a PayPal account: All your questions answered

- Step 1: Sign up for an account

- Step 2: Enter your information

- Step 3: Verify your account

- Step 4: Link your bank account or credit card

- Step 5: Set payment and withdrawal limits

- Step 6: Get familiar with PayPal features

- Step 7: Get help and ask questions

- PayPal Account Types

- Personal Account

- Business Account

- Can I have multiple PayPal Accounts

- Step 3: Verifying your account information

- Verify your mobile number

- Verify your email address

- Get PayPal-verified

- What are you able to do after setting up your PayPal account to receive money

- Getting paid to a personal PayPal account

- Getting paid to a PayPal business account

- Video:

- ⚠️ EMERGENCY MEETING: CRYPTO DECODE 2024 ⚠️ GLOBAL SHIFT HAPPENING NOW! MASSIVE OPPORTUNITY FOR ALL

How to set up a PayPal account: All your questions answered

If you want to start using PayPal for online payments, setting up an account is the first step. With a PayPal account, you can send and receive money, make online purchases, and even withdraw money to your bank account. In this guide, we will answer all your questions and provide step-by-step instructions on how to open a PayPal account.

Step 1: Sign up for an account

To open a PayPal account, go to the PayPal website at www.paypal.com and click on the “Sign Up” button. You will be presented with two options: Personal and Business. Depending on your needs, pick the option that suits you best.

Step 2: Enter your information

Once you click on your desired account type, you will be taken to a page where you need to enter your personal information. This includes your name, address, phone number, and email address. Fill out the required fields and then click “Next” to proceed.

Step 3: Verify your account

To ensure the security of your PayPal account, you will need to verify your email address. PayPal will send a verification code to the email address you provided. Check your email, enter the code, and click “Verify” to complete the verification process.

Step 4: Link your bank account or credit card

To be able to make payments or receive money through PayPal, you need to link your bank account or credit card. PayPal requires this information to verify your identity and to provide you with withdrawal options. Follow the instructions on the screen to link your preferred payment method.

Step 5: Set payment and withdrawal limits

PayPal allows you to set limits on the amount of money you can send or receive. These limits vary depending on the type of account you have and the purpose of your transactions. Consider your needs and set the limits accordingly.

Step 6: Get familiar with PayPal features

Once your PayPal account is set up, take some time to explore the features and options available to you. PayPal lets you send money to others, receive payments for products or services, shop online, and more. Familiarize yourself with the interface and make sure you understand how to use PayPal for your specific purposes.

Step 7: Get help and ask questions

If you have any questions or need assistance, PayPal offers a comprehensive help center. There you can find answers to frequently asked questions and access support articles and tutorials. Additionally, you can contact PayPal directly for further assistance if needed.

Now that you know how to open a PayPal account, you can start using this convenient online payment platform for all your financial transactions. Sign up today and enjoy the benefits of secure and easy money management with PayPal.

PayPal Account Types

When it comes to opening a PayPal account, there are different types you can choose from based on your needs and preferences. Below, we’ll go over the various PayPal account types and what each one offers.

- Personal Account: This is the most common type of PayPal account and is suitable for individuals who want to make online payments, send money to friends and family, or receive payments from others. With a personal account, you can link your bank account or credit card and use PayPal to make payments securely.

- Business Account: If you run a business and want to accept online payments, it’s wise to open a business account. With a business account, you can use your company’s name or a trade name, set up multiple users to access the account, and receive payments from customers. This account type offers additional features such as the ability to create and send invoices, customize the payment page, and use PayPal Here for mobile payments.

Depending on the type of PayPal account you choose, there may be additional steps required to verify your identity. PayPal may ask for more information about your business, such as your address, phone number, or tax ID number. This is done to ensure that PayPal follows regulatory requirements and keeps your account secure.

Here are the steps to open a PayPal account:

- Go to paypal.com and click on the “Sign Up” button.

- Choose the type of account you want to open (Personal or Business).

- Enter your email address and create a password for your account.

- Follow the instructions to enter your personal or business information.

- After providing the required information, click “Agree & Create Account”.

- You will then be asked to link your bank account or credit card to your PayPal account. This step is optional but allows you to withdraw money from your PayPal account.

- Once your account is created and verified, you’ll be able to send and receive payments through PayPal.

It’s important to keep in mind that there may be certain limits on your PayPal account depending on the type of account and the information you provide. PayPal has set these limitations for security purposes and to ensure that you have a positive experience using their services.

If you have any questions about opening a PayPal account or need help verifying your account, PayPal provides a comprehensive guide on their website with answers to frequently asked questions. You can view this content by clicking on the “Help & Contact” link on the PayPal website.

Opening a PayPal account is a wise step if you want to send or receive money online. Depending on your needs and the purpose of the account, you can choose between a personal or business account and enjoy the benefits of using a trusted and widely accepted online payment platform like PayPal.

Personal Account

Opening a personal PayPal account allows you to send and receive money online. Here are the steps to open a PayPal personal account:

- Go to the PayPal.com website and click on “Sign Up” or “Get Started” (depending on the content of the PayPal.com website).

- Choose the “Personal Account” option.

- Enter your email address and create a secure password.

- Fill in the required information, such as your name, address, and phone number. This information is necessary for PayPal to verify your account.

- Once you have entered all the required information, click on “Agree and Create Account”.

- PayPal will then send a verification code to the mobile phone number you provided. Enter the code to verify your account.

- After verifying your account, PayPal may ask you to link a payment source, such as a bank account or credit card. This step is optional but allows you to withdraw money from your PayPal account to your bank account, or make payments using these sources.

- Once your account is set up, you can log in to view your PayPal account balance and transaction history. You can also receive payments from other PayPal users or make payments to others.

It’s important to note that PayPal has certain limits on personal accounts, depending on the type and amount of transactions you plan to make. If you want to lift these limits or have questions about verifying your account, PayPal.com provides instructions and a help guide to assist you.

Please keep in mind that PayPal’s buyer and seller protection policies are only available for verified PayPal accounts. Verification helps ensure that you are a legitimate user and provides an extra layer of security for all parties involved in a transaction.

Having a PayPal personal account lets you buy and sell online, receive money for personal purposes, or get paid for the content you create. PayPal also offers a business account option, which allows you to access additional features depending on your business needs.

If you have any questions about using PayPal or need further assistance, PayPal.com has a dedicated customer support team that can help you with any queries or concerns.

Business Account

If you’re a business owner who wants to receive payments online, opening a PayPal Business account is a wise option. With a PayPal Business account, you can send and receive payments for multiple purposes such as buying and selling goods or services.

To open a PayPal Business account, follow these easy steps:

- Go to the PayPal website at www.paypal.com.

- Click on the “Sign Up” button.

- Choose the “Business Account” option.

- Enter your email address and create a password for your account.

- Provide the required information about your business, such as your business name, address, and phone number. This information is necessary to verify your account.

- Once you’ve entered all the required information, click on the “Continue” button.

- Follow the instructions to verify your account. This usually involves confirming a code that PayPal sends to your email or mobile phone.

- After verifying your account, you can then set up your business account settings, such as the types of payments you want to receive and any limits you want to set.

- Once your account is set up, you can start using it to receive payments. Simply provide your PayPal email address to buyers and they can send you money through PayPal.

It’s important to note that PayPal Business accounts have certain limits depending on the type of account you have. You can view these limits and get more information on the PayPal website.

If you have any questions or need further assistance, PayPal provides helpful advice and answers to frequently asked questions on their website. You can also contact their customer support for more personalized help.

Setting up a PayPal Business account lets you receive payments online and provides you with a secure and convenient way to manage your business transactions. So, if you’re a business owner looking to get paid online, opening a PayPal Business account is the way to go.

Can I have multiple PayPal Accounts

Yes, it is possible to have multiple PayPal accounts. However, there are some guidelines and restrictions that you need to keep in mind when setting up multiple accounts.

If you need to manage a large amount of money, have different sources of income, or want to keep your business and personal finances separate, having multiple PayPal accounts can be helpful.

Here are some instructions on how to open and manage multiple PayPal accounts:

- Go to the PayPal website at www.paypal.com and click on the “Sign Up” button to create a new account.

- Follow the step-by-step guide and enter your personal and address information. You may be required to verify your email address and link it to your new account.

- Depending on your specific needs, choose the type of account you want to open. PayPal offers personal, business, and mobile payment options.

- Once you have completed the account setup, you can start getting payments through your new PayPal account.

- Keep in mind that there are some limits and restrictions when using multiple PayPal accounts. PayPal may ask you to verify your identity or provide additional information before you can receive or withdraw a certain amount of money.

- If you are using multiple PayPal accounts for different purposes, it is wise to keep track of all your accounts and their respective limits to avoid any confusion or violation of PayPal’s terms of service.

- Remember that being PayPal-verified can help you increase your limits and security.

Having multiple PayPal accounts can be beneficial for various reasons, but make sure to read and understand PayPal’s terms and guidelines before opening additional accounts.

For more information and help with managing multiple PayPal accounts, you can visit the PayPal website or contact their customer support through phone or email.

Step 3: Verifying your account information

After signing up for a PayPal account, you will need to verify certain information to fully access all the features and benefits of PayPal. Verifying your account is an important step in ensuring the security and authenticity of your PayPal transactions.

Here’s how you can complete the verification process:

- Log in to your PayPal account using your email address and password.

- Click on the “Settings” icon, which looks like a cogwheel, located at the top right corner of the page.

- Select the “Account settings” option from the drop-down menu.

- Under the “Account summary” section, you will find a “Verification” status. Click on the “Get Verified” link next to it.

- PayPal wants to make sure that the information you have provided is accurate. You may be required to answer some questions about your personal or business identity, depending on the type of account you are opening.

- Some of the questions may include your address, phone number, or other details associated with your PayPal account.

- Once you have answered the questions, PayPal will verify the information you provided.

- You may also be required to link and confirm your debit or credit card to ensure the security of your account.

- After completing these steps, PayPal will usually send a small amount of money to your linked bank account along with a unique code.

- Once you receive the money, log in to your PayPal account again and enter the code to confirm and complete the verification process.

Verifying your PayPal account has several benefits. It allows you to remove some content and spending limits that may be imposed on unverified accounts, enabling you to send and receive larger amounts of money. Additionally, being PayPal-verified inspires trust and confidence in online transactions, making it a wise step for both personal and business purposes.

Remember, the exact steps for verifying your account may vary depending on your location and the type of PayPal account you are using. The instructions provided by PayPal on their website can guide you through the process. If you need further assistance, PayPal’s online help center and multiple sources of advice can be of great help.

Verify your mobile number

Verifying your mobile number is an important step when opening a PayPal account. It helps PayPal to ensure the security of your account and also enables you to receive important notifications about your account and any payments you make or receive.

To verify your mobile number, follow these steps:

- Log in to your PayPal account at www.paypal.com

- Click on the “Settings” icon, usually located in the top right corner of the page

- Click on “Phone” under the “Account” settings

- Click on the “Add” button to enter your mobile phone number

- Type your mobile number in the required field and click “Save”

- You will receive a text message with a verification code

- Enter the code in the designated field and click “Confirm”

By verifying your mobile number, you are taking an important step towards setting up a PayPal account that can be used for various purposes, such as making and receiving payments online, sending money to family and friends, or even for business transactions.

It’s worth mentioning that PayPal has certain limits and restrictions depending on the type of account you have. For example, if you have a personal account, there might be limits on the amounts you can send or withdraw. However, if you have a PayPal-verified business account, you may have more options and fewer restrictions.

Keep in mind that PayPal may ask you for additional information to verify your account, such as your address or answers to security questions. This is to ensure the safety of your account and to prevent any unauthorized access.

If you need further help or have any questions about verifying your mobile number, you can visit the PayPal Help Center or contact PayPal’s customer support. They have a wealth of knowledge and resources to assist you in getting your PayPal account up and running smoothly.

In conclusion, verifying your mobile number is a wise step to take when opening a PayPal account. It helps secure your account, enables you to receive important notifications, and gives you access to various payment options and features. So, don’t hesitate, get started on the verification process and enjoy the convenience and benefits of using PayPal for your online transactions.

Verify your email address

When you open a PayPal account, one of the first steps you need to do is verify your email address. This is an important process that helps ensure the security of your account.

To verify your email address, follow these steps:

- Login to your PayPal account using the email address and password you set up during the sign-up process.

- Once you’re logged in, click on the “Settings” icon, which is usually represented by a gear or a cog.

- In the settings menu, click on the “Email” option.

- You will see a list of email addresses associated with your PayPal account. Pick the email address that needs to be verified.

- Click on the “Confirm” button next to the email address you picked.

- PayPal will send a verification code to the email address you entered. Go to your email inbox and look for the email from PayPal.

- Open the email and follow the instructions provided by PayPal to enter the verification code.

- Once you’ve entered the code, click on the “Verify” button.

- If you’ve followed all the steps correctly, your email address will be verified and you will receive a confirmation from PayPal.

It’s wise to keep in mind that PayPal may also require you to verify your phone number as an additional security step, depending on the type of account you have.

Verifying your email address on PayPal has several benefits. First, it ensures that you’re the rightful owner of the email address being used for account purposes. Second, it helps PayPal reduce the limits on the amounts you can send and receive through your account. Lastly, once verified, you can set up your PayPal account to receive payments from multiple sources, such as online buyers or business transactions.

If you have any questions about verifying your email address or need further help, PayPal’s website (paypal.com) has a comprehensive Help section that usually has all the answers you’re looking for.

Get PayPal-verified

If you want to fully utilize all the features PayPal has to offer, it’s important to become PayPal-verified. Being PayPal-verified means that PayPal has confirmed your identity, making you a more trusted member of the PayPal community.

Here are the steps to become PayPal-verified:

- First, sign in to your PayPal account. If you don’t have an account yet, you can easily open one on paypal.com by clicking on the “Sign Up” button.

- Once you’re signed in, click on the gear icon in the top right corner of the screen. From the dropdown menu, select “More” and then “Settings”.

- On the left-hand side of the page, click on “Get Verified”.

- You will be prompted to provide some personal information, such as your name, address, phone number, and email address. Fill in all the required fields.

- PayPal may also ask you to confirm your identity by linking and confirming a credit or debit card, or by providing your Social Security Number. Follow the instructions provided.

- After entering all the necessary information, PayPal will review your account and make a decision on whether to verify you.

- If you’re verified, you will receive an email from PayPal confirming your PayPal-verified status.

Keep in mind that depending on your country, there may be additional steps and requirements for getting verified. PayPal provides instructions tailored to each country to help you through the process.

Being PayPal-verified not only lets you have higher sending and withdrawal limits, but it also gives buyers more confidence when they see that you’re PayPal-verified. It’s a wise step to take if you’re using PayPal for online transactions.

Remember that this guide is for informational purposes only and doesn’t provide specific advice. PayPal wants to ensure the safety of its community, so make sure to follow all the instructions provided on the PayPal website to get verified.

What are you able to do after setting up your PayPal account to receive money

Once you have set up your PayPal account to receive money, you will be able to do a variety of things. Here is a guide to what you can do:

1. Send and receive money: With your PayPal account, you can send and receive money to and from other PayPal accounts. You can also send money to anyone with an email address, even if they don’t have a PayPal account. This makes it easy for you to pay friends back, split bills, or make purchases online.

2. Link multiple accounts: PayPal allows you to link multiple bank accounts and credit/debit cards to your account. This gives you flexibility in choosing the payment method you want to use for each transaction.

3. View transaction history: PayPal provides you with a detailed transaction history, which lets you keep track of all the payments you have made and received. You can view this information online, and it is especially helpful for those who use PayPal frequently for various purposes.

4. Withdraw funds: If you have money in your PayPal account, you can easily withdraw it to your linked bank account. PayPal usually offers multiple withdrawal options, depending on your location and account type.

5. Verify your account: To enjoy full access to all PayPal features and to remove certain limits on your account, you may need to verify your account. PayPal may require you to confirm your email address, link a phone number, or provide additional information about yourself.

6. Buyer and seller protection: PayPal offers buyer and seller protection, which helps ensure that both parties are protected in case of disputes or fraudulent activities. This provides peace of mind when buying or selling online.

7. Use a PayPal.me link: PayPal.me is a feature that allows you to create a personalized URL that you can share with others. This link lets others easily send you money without needing your email address or phone number.

8. Use PayPal on various platforms: PayPal can be used on various platforms and devices, including websites, mobile apps, and even in physical stores. This flexibility enables you to make payments wherever you are and whenever you need to.

Setting up a PayPal account opens up a world of possibilities for managing your money online. From sending and receiving money to viewing your transaction history, PayPal provides a convenient and secure way to handle your financial transactions. So, what are you waiting for? Sign up for a PayPal account at paypal.com and start using it today!

Getting paid to a personal PayPal account

If you’re wondering how to open a PayPal account and receive payments, you’ve come to the right place. A personal PayPal account allows you to send and receive money online, making it a convenient and secure way to handle your finances.

To open a personal PayPal account, follow these steps:

- Go to the PayPal website at www.paypal.com.

- Click on the “Sign Up” button.

- Choose the “Personal account” option.

- Fill in your email address, create a password, and enter your personal information.

- Click on the “Next” button.

- Enter your credit card or bank account information. This is required for verification purposes and will enable you to send or receive money.

- Review and agree to PayPal’s policies and user agreement.

- Click on the “Agree and Create Account” button.

- PayPal will send you a code to your phone number or email address for verification. Enter the code to verify your account.

- Once your account is set up, you can start receiving payments.

When someone wants to send you money to your PayPal account, they can do so by following these steps:

- Log in to their PayPal account or create a new one.

- Click on the “Send” option.

- Enter your email address or mobile number as the payment recipient.

- Type in the amount they want to send and pick the currency.

- Click on the “Continue” button.

- Review and confirm the payment details.

- Click on the “Send Money” button.

It’s important to note that depending on the type and amount of payment you receive, PayPal may ask you to provide more information for security and regulatory purposes. PayPal also has payment limits depending on your account status and verification level.

Once you receive payments to your personal PayPal account, you can then use the money to make online purchases or withdraw it to your linked bank account. PayPal also lets you link your mobile number with your account, making it easier to send and receive money through the PayPal mobile app.

If you have any more questions about getting paid to a personal PayPal account, PayPal’s website provides a comprehensive guide with instructions and frequently answered questions to help you navigate the process and make the most out of your PayPal account.

Using a personal PayPal account is a wise choice for individuals who want a simple and secure way to receive payments and manage their money online.

Getting paid to a PayPal business account

Once you have opened a PayPal business account, you can start receiving payments for your business. In order to receive payments, you will need to provide certain information to your customers or clients. Here are the steps to follow:

- Sign in to your PayPal account on paypal.com.

- Click on the “Settings” icon (a gear symbol) at the top of the page.

- In the dropdown menu, select “Payments”.

- Under the “Getting paid and managing my risk” section, click on the “Update” link for “Manage payments” option.

- In the “Get paid with PayPal” section, click on the “Set up” link.

- Follow the instructions to set up your payment preferences, including the types of payments you want to accept and any limits you want to set.

- Depending on your business needs, you may be required to provide additional information such as your business address, phone number, or tax ID.

- Once you have completed the set-up process, you will be able to receive payments directly to your PayPal business account.

When someone wants to pay you, they can simply enter your email address or mobile phone number associated with your PayPal account. They will then be able to send you the desired amount of money.

For security purposes, PayPal may ask you to verify your account by linking it to a bank account or adding a credit card. This helps ensure that you are a legitimate business owner.

Keep in mind that there may be fees associated with receiving payments. PayPal offers different types of accounts with varying fee structures, so make sure to check their website for more information.

Once you start getting paid to your PayPal business account, you can view all your incoming payments and manage your account settings through the PayPal website or mobile app.

It’s wise to follow PayPal’s advice on how to protect your account and prevent scams or fraud. They have a comprehensive guide on their website that answers common questions and provides tips on maintaining a secure account.

With a PayPal business account, you have the option to withdraw money to your linked bank account, use it to make online purchases, or send it to other PayPal users.

Remember that getting paid to your PayPal business account usually requires some additional steps compared to a personal account. But once everything is set up, you’ll be ready to receive payments for your business!