Managing money is a crucial skill that most people strive to improve. By putting certain financial strategies into practice, you can not only ensure that you have enough to cover your bills and expenses each month but also build up savings for the future. In this article, we will provide you with some tips to help you manage your money more effectively.

The first step in managing your money better is to track your income and expenses. By keeping a daily record of how much money you earn and where you spend it, you become more aware of your financial situation. This way, you can make smarter decisions about your spending and avoid overspending.

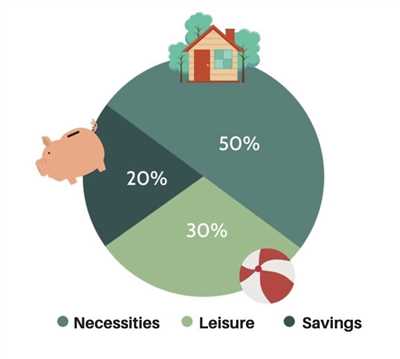

Creating a budget is another essential aspect of money management. By determining how much money you make and how much you spend each month, you can set limits on your spending and avoid accumulating debt. A budget also helps you allocate your income towards savings, investments, or paying off loans. By sticking to your budget, you can start building up your savings and avoid unnecessary expenses.

Another tip to manage your money better is to avoid making impulsive purchases. Before buying something, think whether it is a necessary expense or an impulse buy. By giving yourself some time to think, you can determine whether you really need the item or if it’s just a temporary desire. If you can, try to save up for big purchases rather than using credit cards or taking out loans. This way, you can avoid paying high interest rates and save more in the long run.

Many people find it helpful to open separate accounts for different financial goals. For example, you can have one account for your monthly bills and expenses, another for your savings, and yet another for long-term investments. By separating your money, you can ensure that your bills are always paid on time and that your savings are not easily accessible for impulse purchases. This way, you can stay on track with your financial goals and build a strong financial foundation for yourself.

In conclusion, managing your money better is a process that requires discipline, planning, and smart decision-making. By tracking your income and expenses, creating a budget, avoiding overspending, and setting financial goals, you can take control of your finances and secure a better future. Start implementing these tips today and see the positive impact it will have on your financial well-being.

7 money management tips to improve your finances

Managing your money effectively is a crucial skill that can have a profound impact on your financial well-being. With the right strategies, you can avoid overspending, build savings, and make better financial decisions. Here are 7 money management tips to help you improve your finances:

| 1. Create a budget | Start by determining your monthly income and expenses. Take a close look at where your money is going and think about where you can cut back. By creating a budget, you can track your spending and make sure you’re putting your money towards things that truly add value to your life. |

| 2. Limit unnecessary purchases | Before making any purchases, ask yourself if it’s something you truly need or if it’s something you can live without. By avoiding impulse buying, you can save a significant amount of money over time. |

| 3. Save before you spend | Make saving a priority by putting money aside before you start spending. This way, you won’t be tempted to spend all your available funds and you’ll have a safety net in case of emergencies. |

| 4. Pay off high-interest debt | If you have any loans or credit card debt, prioritize paying off the ones with the highest interest rates first. By doing so, you’ll save money on interest payments and reduce your overall debt faster. |

| 5. Open a savings account | Having a separate savings account can help you keep your saved money separate from your everyday expenses. It also allows you to earn interest on your saved capital, thus helping it grow over time. |

| 6. Think long term | When making financial decisions, consider the long-term impact. This includes planning for retirement, saving for future goals, and investing your money wisely. By thinking ahead, you can ensure a more secure and comfortable financial future. |

| 7. Seek professional advice | If you’re unsure of how to manage your finances or if you’re facing complex financial situations, it’s wise to seek advice from a financial professional. They can help you determine the best strategies for your specific situation and guide you in making smart decisions. |

By implementing these money management tips into your daily life, you can take control of your finances and improve your overall financial well-being. Remember, managing your money better starts with small steps and consistent effort, so start today and reap the benefits in the years to come.

Money management on the go

Managing your finances is crucial in today’s fast-paced world, where financial decisions and transactions happen on the go. Whether you are at home, work, or traveling, it’s important to have a solid understanding of how to manage your money effectively. By implementing smart money management tips and making certain financial decisions, you can improve your financial situation and build a better future for yourself.

Start by creating a monthly budget to track your income and expenses. Determine how much money you have coming in each month and where it goes. This will help you avoid overspending and take control of your finances. By putting together a budget, you’ll know exactly how much you can afford to spend on each category, such as necessities, bills, and savings.

When making purchases, think about the value they will bring to your life. Avoid impulse buying and consider whether the item is necessary or if it can wait. By doing so, you will avoid unnecessary expenses and make sure that you’re putting your money towards what truly matters to you.

Carry only essential credit and debit cards with you to avoid overspending. It’s easy to get carried away with spending when you have multiple cards at your disposal. By limiting yourself to only what you need, you can avoid the temptation to make unnecessary purchases and stay within your budget.

If you find yourself struggling with debt, start by paying off high-interest loans and credit cards first. By doing this, you’ll save more money in the long run and improve your financial situation. It’s a good idea to prioritize debt repayment and make extra payments whenever possible.

Take advantage of technology to help you manage your money better. There are many apps and online tools available that can assist in tracking your expenses, setting financial goals, and automating your savings. These sources will make the process of money management easier and more convenient.

Improve your financial management skills by continuously educating yourself. Read books, attend seminars, and seek guidance from financial experts to gain a deeper understanding of how to make smart financial decisions. The more you know about money management, the better equipped you will be to handle your finances.

Remember that financial management is an ongoing process. It’s not a one-time thing but a habit that you need to develop. Check your budget regularly to ensure that you’re staying on track, and adjust it as necessary. Over time, you’ll see your savings grow and your financial situation improve.

In conclusion, money management on the go is possible with the right mindset and strategies. By being aware of your spending habits, taking control of your finances, and making smart decisions, you can build a better future for yourself and achieve your financial goals.

Track your spending to improve your finances

One of the most important aspects of managing your money effectively is to track your spending. By keeping a record of where your money goes, you can gain better insights into your financial habits and make necessary adjustments to improve your overall financial situation.

Tracking your spending helps you determine whether you’re making smart financial decisions and putting your money towards the things that really matter to you. It allows you to see how much money you’re spending on certain things and whether you need to set a limit or cut back on unnecessary purchases.

Start by creating a budget, where you allocate a certain amount of money for various categories such as groceries, bills, entertainment, etc. This will help you keep track of your monthly expenses and make sure you’re not overspending.

There are many ways to track your spending. You can use a daily spending log, where you write down every purchase you make throughout the day. You can also use smartphone apps or online tools that link to your bank accounts and automatically categorize your expenses.

When you track your spending, it’s important to be honest with yourself. If you find that you’re spending more than you can afford, it might be time to reevaluate your lifestyle and make necessary adjustments to get your finances back on track.

Tracking your spending also helps you identify areas where you can save money. For example, you may realize that you’re spending a significant amount on dining out, and by making small changes like cooking at home more often, you can save a substantial amount of money over time.

Moreover, tracking your spending allows you to build up your savings. By monitoring your expenses, you can identify areas where you can cut back and put that extra money towards savings or paying off debt.

Finally, tracking your spending helps you manage your money better by preventing overspending and impulse purchases. Knowing how much money you have and how much you’ve already spent can help you make more informed decisions about whether to make a purchase or not.

Overall, tracking your spending is an essential part of effective money management. It helps you stay on top of your finances, avoid debt, and build a better financial future. So start tracking your spending today and see how it can improve your financial life.

Tip 2: Determine Your Monthly Pay

One of the most important steps in managing your money better is to determine your monthly pay. Understanding your income is crucial for making smart financial decisions and planning for the future. Here are some tips to help you determine your monthly pay and improve your money management:

- Track Your Income: Start by tracking all sources of income you receive each month. This includes your salary, bonuses, tips, and any other money you earn. Make sure to be certain about the amount and frequency of each payment.

- Account for Deductions: If you have any deductions or taxes taken out of your pay, subtract them from your total income to get your net monthly pay. This will give you a more accurate picture of how much money you have to work with each month.

- Consider Extra Income: If you have any other sources of income, such as a side gig or rental property, be sure to include that as well. This extra income can help you build up your savings or pay off debt faster.

- Set a Budget: Once you know how much money you have coming in each month, it’s important to set a budget. Determine how much you need to spend on necessary expenses like bills and groceries, and then allocate the rest towards savings or other financial goals.

- Avoid Overspending: Be mindful of your spending habits and try to limit unnecessary purchases. It’s easy to get carried away with daily expenses, but if you track your spending and think before making a purchase, you can avoid overspending.

- Have an Emergency Fund: It’s always a good idea to have an emergency fund in case unexpected expenses arise. Aim to save at least three to six months’ worth of expenses in case of job loss or other financial emergencies.

- Manage Your Debt: If you have debt, make sure to prioritize paying it off. Put extra money towards your highest interest debts first and then work your way down. The sooner you can pay off your debt, the more financial freedom you will have.

By determining your monthly pay and following these tips, you can improve your money management and build a better financial future. Start the process of managing your money better today and reap the benefits in the years to come.

How To Manage Your Money Better

Managing your money effectively is an essential skill that everyone should master. By being sure of where your money goes and taking control of your finances, you can avoid overspending and build a better financial future. Here are 7 tips to help you manage your money better:

| Tip 1: | Determine your income and expenses |

| Tip 2: | Create a monthly budget |

| Tip 3: | Track your spending |

| Tip 4: | Saving is a priority |

| Tip 5: | Avoid unnecessary purchases |

| Tip 6: | Limit your debt |

| Tip 7: | Invest and plan for the future |

If you’re unsure of how to start managing your money better, here are a few sources of help:

- Financial management tools and apps

- Online resources and educational courses

- Financial advisors or consultants

- Books and literature on personal finance

By putting these tips into practice, you can start making better financial decisions and improve your overall financial well-being. Whether you’re aiming to pay off debt, save for a certain goal, or simply have more control over your money, managing your finances effectively will help you get there.

Avoid debt

Managing your finances starts with avoiding debt. Debt can be a burden that keeps you from achieving financial freedom and reaching your goals. Here are some smart tips to help you avoid debt and improve your financial management:

| 1. Start with a budget: Creating a monthly budget is essential for good financial management. It helps you track your income and expenses, determine how much you can afford to spend, and save for the future. Make sure to include savings as a priority in your budget. |

| 2. Limit your spending: Think critically about each purchase and whether it’s a necessary expense. Avoid overspending on things you don’t need or can’t afford. By making smart choices, you’ll be able to build up your savings and avoid unnecessary debt. |

| 3. Avoid high-interest debt: If you have certain financial obligations, such as loans or credit card debt, make it a priority to pay them off as soon as possible. High interest rates can quickly accumulate and become a burden on your finances. Put extra money towards paying off these debts and save on interest in the long run. |

| 4. Use credit cards wisely: If you open a credit card, make sure to use it responsibly. Only charge what you can afford to pay off in full each month. This way, you can take advantage of the benefits that credit cards offer, such as cashback or rewards, without getting into debt. |

| 5. Plan for the unexpected: Life is unpredictable, and unexpected expenses can arise. By having an emergency fund, you can avoid going into debt when faced with a financial setback. Aim to save at least three to six months’ worth of expenses to provide a safety net for yourself. |

By following these tips, you can avoid debt and make sure that your financial management is on track. Remember, it’s not just about having more money, but also about using it wisely to achieve your goals and live a better life.

Sources

Improving your financial management starts with determining your sources of income and understanding where your money is going. By taking a closer look at your finances, you can better budget and make decisions that will help you manage your money more effectively.

Here are 7 sources to consider:

| 1. | Income |

| 2. | Spending |

| 3. | Savings |

| 4. | Debt |

| 5. | Loans |

| 6. | Investment |

| 7. | Bills |

Once you have determined your sources of income and where your money is going, you can start the budgeting process. Budgeting helps you make sure you are putting your money towards what is most necessary and valuable in your life.

Here are some tips to help you manage your money better:

- Open a savings account to start saving money and build capital.

- Keep track of your daily expenses to avoid overspending.

- Think twice before making unnecessary purchases.

- If you have debts, prioritize paying them off.

- Consider whether it would be beneficial to seek financial help or a loan.

- Set a budget limit for each month and stick to it.

- Put any extra income or savings into a high-interest savings account.

By following these tips, you can improve your financial management and make better decisions about how to manage your money. Remember, it’s never too late to start taking control of your finances and building a better financial future.